A business that specializes in helping families and patients find the best live in care facility for their needs.

Senior living reits 2018.

Written by mary kate nelson.

2018 by market cap top u s.

Risks of investing in senior living reits.

Health care reits own and manage a variety of health care related real estate and collect rent from tenants.

A health care real estate investment trust known as reit could be a smart move if you want to capitalize on aging trends by including senior housing medical and nursing facilities in their.

As of market close on tuesday ventas nhi and hcp were all down between 1 and 2 17.

Nursing home placement companies provide services.

Still in the meantime investors do not appear keen on the senior living reits.

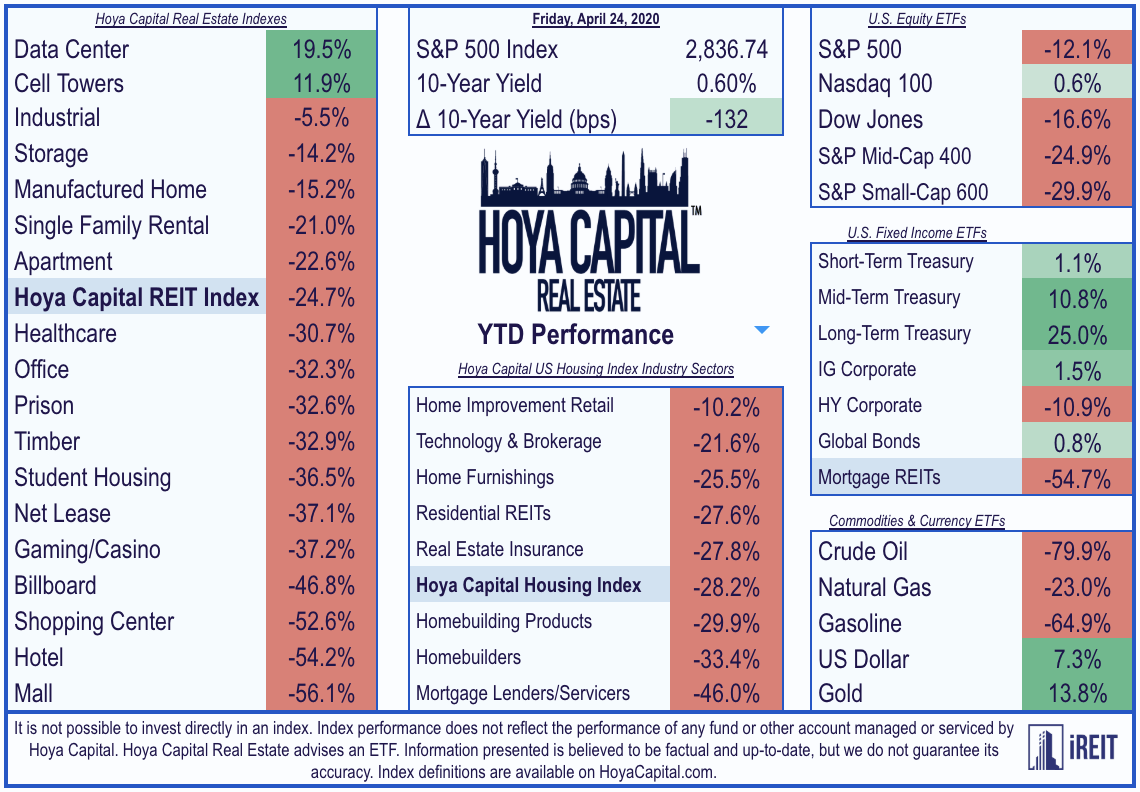

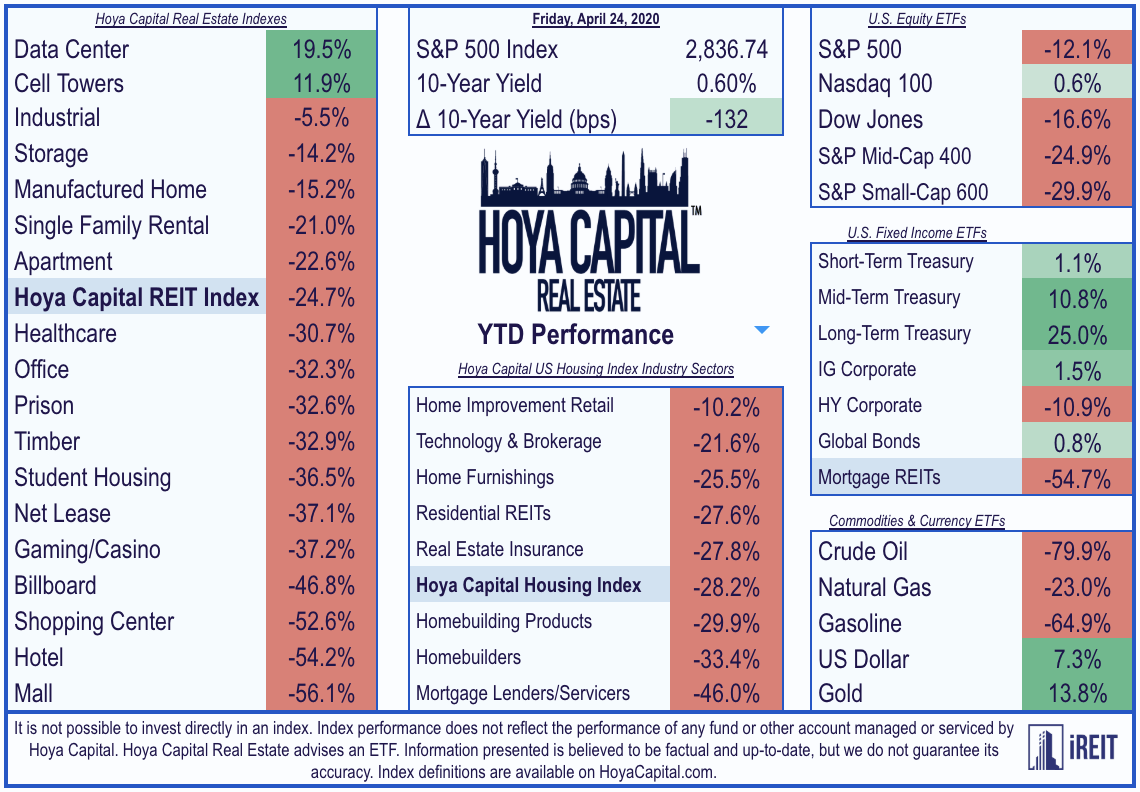

In the final quarter of 2018 the s p 500 dropped 10.

In addition senior housing s real estate holdings have much greater potential to appreciate.

When interest rates and inflation first begin to rise after remaining flat for many years reits often.

Leading senior assisted living companies in the u s.

Hcp are creating the next generation of space intended to attract new talent particularly millennials.

The portfolio is 71 skilled nursing facilities 19 assisted independent living senior housing and only 10 non senior focused properties.

Not for profit senior living organizations by total living units 2018 the most important statistics.

Nursing home placement service.

With the broader markets queasy about trade war tensions assisted living stocks to buy offer steady large scale demand.

Health care reits property types include senior living facilities hospitals medical office buildings and skilled nursing facilities.

According to jll s 2017 life sciences outlook two reits alexandria real estate equities inc.